23+ My debt to income ratio

Heres how the debt ratio is rated. Under the heading Results you can see a pie chart of your debt to income ratio.

Your Debt To Income Ratio Is All Your Monthly Debt Payments Divided By Your Gross Monthly Income This Number Is Debt To Income Ratio Home Buying Process Debt

It shows your total income total debts and your debt ratio.

. How To Calculate Debt-To-Income Ratio. The back-end DTI ratio shows the income percentage covering all your monthly debts. Get Offers From Top Lenders Now.

Your debt-to-income ratio is calculated by dividing your total monthly expenses by your monthly gross income. To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Lenders assess a persons debt-to-income ratio when considering loan.

Ages 18 to 23. 475 68 votes Key Takeaways. To calculate his DTI add up his monthly debt and mortgage payments and divide it by his gross monthly income to get 032.

It is calculated by adding up your total monthly bills such as your credit card debt payments. Ad Looking to Lower Your Debt. Find Out If You Qualify Today.

Multiply that by 100 to get a percentage. To calculate your debt-to-income ratio establish what your total monthly. To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan payments auto loan payments and credit card.

Ad Get Your Best Interest Rate for Your Mortgage Loan. Finally divide your total monthly debt payments by your monthly income to find out your DTI. Debt-to-Income Ratio Definition.

Compare Quotes Now from Top Lenders. However the gross monthly income for scenario one is 3000 while the gross monthly income for scenario. Lenders use your DTI ratio to gauge your ability.

Multiply that by 100 to get a percentage. Your debt-to-income ratio DTI is the percentage of your monthly gross income that goes towards paying debts. A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Lenders use your debt-to-income ratio to determine whether youre financially able to take on more debt. In addition to your credit score your debt-to-income DTI ratio is an important part of your overall financial healthCalculating your DTI may help you determine how comfortable you are with.

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans The DTI calculator is an estimated ratio of your annual income divided into monthly then. A Mortgage Refinance Could Reduce Your Monthly Payments. Financial experts consider a good debt-to-income ratio as one below 36 for a back-end ratio which means that only 36 of your income goes towards repaying your financial obligations.

Debt-to-income ratio is a measure of how much of your income is used to pay debts each month. Its especially important if youre applying for a mortgage and directly. Is 36 a good debt-to-income ratio.

Consolidate Debt with a Cash Out Refinance. You may even be denied because your DTI is too high. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you.

How Is Debt-to-Income Ratio Calculated. I generally save much more than 20 of my income which instills more discipline in not spending money in the 50other expenses category. To calculate your DTI add the total housing costs with all your total monthly debt payments then divide them by your total gross.

To calculate your debt-to-income ratio first add up your monthly bills such as rent or monthly mortgage payments student loan payments car payments minimum credit card. Lenders use DTI to determine your ability to repay a loan. The 43 rule is a debt-to-income ratio that is used to determine who qualifies for a loan and who does not.

We dont make judgments or prescribe specific policies. See what makes us different. The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt.

For example lets say you pay 1000 for your mortgage 500 for your car and. Receive Your Rates Fees And Monthly Payments. Consider two scenarios with a monthly debt payment of 1500 each.

Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage.

The Neighborhood Finance Guy Gq Accountant Twitter

Analyzing Historical Default Rates Of Lending Club Notes R Bloggers

19 Personal Financial Ratios You Need To Know Millionaire Mob

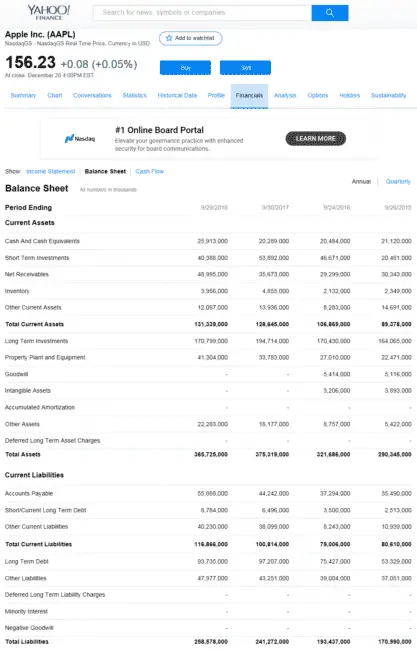

6 No Brainer Ways On How To Read Financial Statements

Debt To Income Ratio Debt To Income Ratio Home Buying Process Real Estate Information

Karen Walsh Key Mortgage

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Mortgage Payment

Karen Walsh Key Mortgage

Karen Walsh Key Mortgage

Do S And Don Ts On Acquiring A Bad Credit Personal Loan

15 Debt Payoff Planner Apps Tools Get Out Of Debt Debt To Income Ratio Managing Finances Money Saving Strategies

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

Do S And Don Ts On Acquiring A Bad Credit Personal Loan

Analyzing Historical Default Rates Of Lending Club Notes R Bloggers

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Debt To Income Ratio Calculator Debt To Income Ratio Income Debt